Housing Market (Fannie Mae and Freddie Mac)Government-Sponsored Entities' (GSEs)

Interference in the

Housing Market

The Federal Home Loan Bank System was created in 1932 by the Federal Home Loan Bank Act, in an attempt to reduce the growing number of home foreclosures, and to spur increased home construction and home ownership. The FHLB laid the groundwork for enormous government interference in the housing market, as well as in the thrift savings and loan market, claimed to have been authorized under Article I, Section 8, "To regulate commerce...among the Several states". Modeled after the Federal Reserve, the FHLB appeared to have stabilized the thrift savings and loan institutions, until rising interest rates in the late 1970s and early 1980s caused the costs of short-term deposits to exceed revenue from long-term mortgages, and hundreds of thrifts failed. Approximately $40 billion of the $105 billion appropriated to bail out the thrifts, was not repaid by the savings and loan institutions, leaving taxpayers to pick up the tab.

FNMA (Federal National Mortgage Association), aka "Fannie Mae", was created in 1938, in an attempt by the federal government, to improve liquidity of mortgage lenders. Although Fannie was originally permitted to only purchase VA/FHA loans, this authority was later expanded, to include conventional mortgages. Fannie Mae was converted to a GSE in 1968, to reduce the apparent size of the federal debt.

FHLMC (Federal Home Loan Mortgage Corporation), aka "Freddie Mac", was created in 1970, ostensibly to prevent a monopoly of the mortgage market, by Fannie Mae. Although Freddie tends to purchase loans from thrifts, and Fannie tends to purchase loans from banks, both GSEs have the same business model. Both have benefited from the implication that the federal government would step in and bail them out, in the event of severe housing market declines.

During the 1990s and 2000s, whether due to pressure to make loans in underserved communities, or to a desire for growth and profits by the boards of Fannie and Freddie, credit restrictions, borrower documentation, and down payment requirements, were substantially loosened. Loans that were previously considered too risky, gradually gained the status of "prime" mortgages. Accounts as to the cause of the loosening of credit restrictions vary from blaming Wall Street, to blaming Fannie and Freddie, although if a loan would meet Fannie or Freddie's continually reduced standards to be considered "prime" and therefore suitable for purchase, the loan was approved.

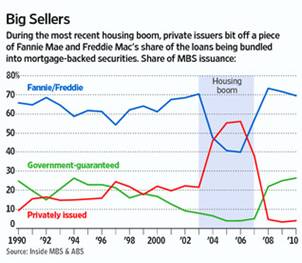

Due to the removal of risk that would result from unrestricted free-market forces, as a result of implied government backing, and lack of oversight and adequate reserves, during a period when their market share began to decline, Fannie and Freddie invested in increasingly riskier mortgage derivatives. The response of Fannie and Freddie to their decreasing market share, was to participate in the purchases of less-than-prime paper and mortgage-backed securities, right up to the point of the bursting of the real estate bubble, in 2007 (see chart below).

From: http://blogs.wsj.com/marketbeat/2011/02/11/fannie-and-freddie-the-saga-in-charts/

Since 2008, the GSEs Fannie and Freddie, along with Ginnie Mae (a wholly-owned government subsidiary that purchases FHA/VA/USDA/BIA loans), back 90% of home mortgages, in the United States. The federal government does not want to accept the responsibility for its interference, and constituents want home mortgages to remain subsidized at lower rates, so mortgage rates remain lower than private investors are willing to purchase.

Following the losses suffered by Fannie and Freddie, as homeowners increasingly defaulted on their mortgages, these GSEs have been taken over by the federal government, and are currently monitored by the Federal Housing Finance Agency. Although subprime mortgage defaults were the first indicator of trouble in the mortgage market, the value of prime loans in default, exceed that of subprime mortgages. Fannie and Freddie hold roughly $5 trillion in mortgages, or slightly less than half of the total mortgage market.

Solutions: Restore Risk as a Regulator, End Federal Government Interference

1. End Bailouts that Encourage Risky Lending Behavior Many financial institutions were ultimately prevented from suffering the consequences of their risky investment decisions, due to bailouts by the federal government. This reliance on the operating principle of "too big to fail" has exacerbated the subprime crisis, and is a large contributor to the reckless behavior of lending institutions originating, selling, or purchasing, questionable mortgages. The practice of bailing out financial institutions by the federal government, must be discontinued, as it encourages risky and unsound lending, as well as mortgage-backed security investment decisions.

2. Allow Home Mortgage Interest Rates to Achieve Market-Determined Level With government interference, 30-year fixed-rate mortgages are currently (June 2011) at about 4.5%. Some analysts have estimated Fannie and Freddie's impacts to be as high as 300 basis points, so if the GSEs were wound down, and prevented from continuing to backstop home mortgages at the taxpayers' expense, 30-year fixed rates could jump to 7.5%. As bad as this sounds, from 1972-2010, interest rates rarely dipped below 7%, and averaged over 8.9% (data taken from http://www.freddiemac.com/pmms/pmms30.htm). In 2008, non-conforming loans were purchased at rates only 100-150 basis points over the GSE-backed conforming loans, indicating that home mortgage interest rates might not have too far to go, to restore free market conditions.

(also see section on Primary Private Banks)

3. Eliminate the Federal Government from the Housing Market Wind down the government-sponsored entities, and do not replace them, with federal government substitutes. As tempting as it is for elected officials to offer "candy" to their constituents, in the form of subsidized home mortgages, it is not appropriate for the federal government to engage in the theft required to orchestrate this redistribution of taxpayers' money.

Eliminate federally-backed mortgage insurance. Instead, allow the private market, to properly determine mortgage insurance rates.

Limit, or eliminate, the ability of Fannie and Freddie to purchase loans, until their assets can be sold, and the GSEs, terminated.

Entities with for-profit motives, and unlimited ability to take on risk, should not be created.

Lenders that engage in any sort of discriminatory practices should be prosecuted to the full extent of the law. Lenders should be permitted to make loans, based on the ability of borrowers to repay them, without regard to "classification" of the borrower.

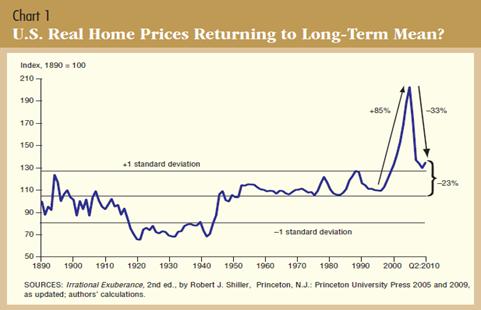

4. Allow the Housing Market to Correct Itself Government efforts to continually and artificially prop up the housing market, will continue to harm taxpayers through increased spending and debt. There is no way to cheat the system, as the market cannot be continuously prevented from reaching its equilibrium. The only question is, how much more will the taxpayers be burdened by continuing to bail out the poor investment decisions by Fannie and Freddie executives?

As the following chart shows, we could be 23%, or more, from the "bottom" in this housing slump. From: http://dallasfed.org/research/eclett/2010/el1014.html

5. End Preferences to Government Entities for REO Purchases Properties that have been foreclosed on, by Fannie and Freddie, allow government entities to bid on foreclosed homes, before bids from private investors, may be considered. Investor bids should receive the same consideration as government entities, when purchasing foreclosed properties.

6. Eliminate Property Taxes A sovereign individual is able to own their property, free from government-imposed "rent" in the form of property taxes. Property taxes are largely used to fund government-sponsored schools, and must be paid, regardless of the school quality. In many school districts, the residents have no choice about which school, their children may attend. Elimination of property taxes, would make housing more affordable. Elimination of property taxes would also remove a common justification for forcible taking of private property by government. In recent eminent domain cases, governments have justified their infringement on property owners' rights, by citing increased property taxes for their development schemes.

|